AI Data Automation with Bika.ai: Unlocking New Potential for Automated Currency Data Retrieval (JavaScript) in Risk Assessment

AI Data Automation: Revolutionizing Risk Assessment

In today's highly competitive business world, the ability to make informed decisions quickly and accurately is crucial. This is especially true in the realm of risk assessment, where even the slightest oversight can lead to significant losses. One of the key tools that businesses are turning to in order to gain a competitive edge is AI data automation. But what exactly makes AI data automation so essential, and how can it transform the way we handle risk assessment?

## Why is AI Data Automation Crucial in Today's Business Landscape

The business landscape is evolving at an unprecedented pace, and organizations are constantly under pressure to stay ahead of the curve. In the context of risk assessment, manual data processing and analysis simply can't keep up with the volume and complexity of information. Inefficiencies in data collection, analysis, and reporting can lead to delayed decisions and missed opportunities.

Common pain points include the time-consuming nature of manual data entry, the potential for human error, and the inability to scale effectively as the volume of data increases. This is where AI data automation comes into play.

The Automated Currency Data Retrieval (JavaScript) template from Bika.ai offers a game-changing solution for risk assessment. By leveraging AI-driven automation, it ensures that data is collected, processed, and analyzed accurately and efficiently, providing real-time insights that enable better decision-making.

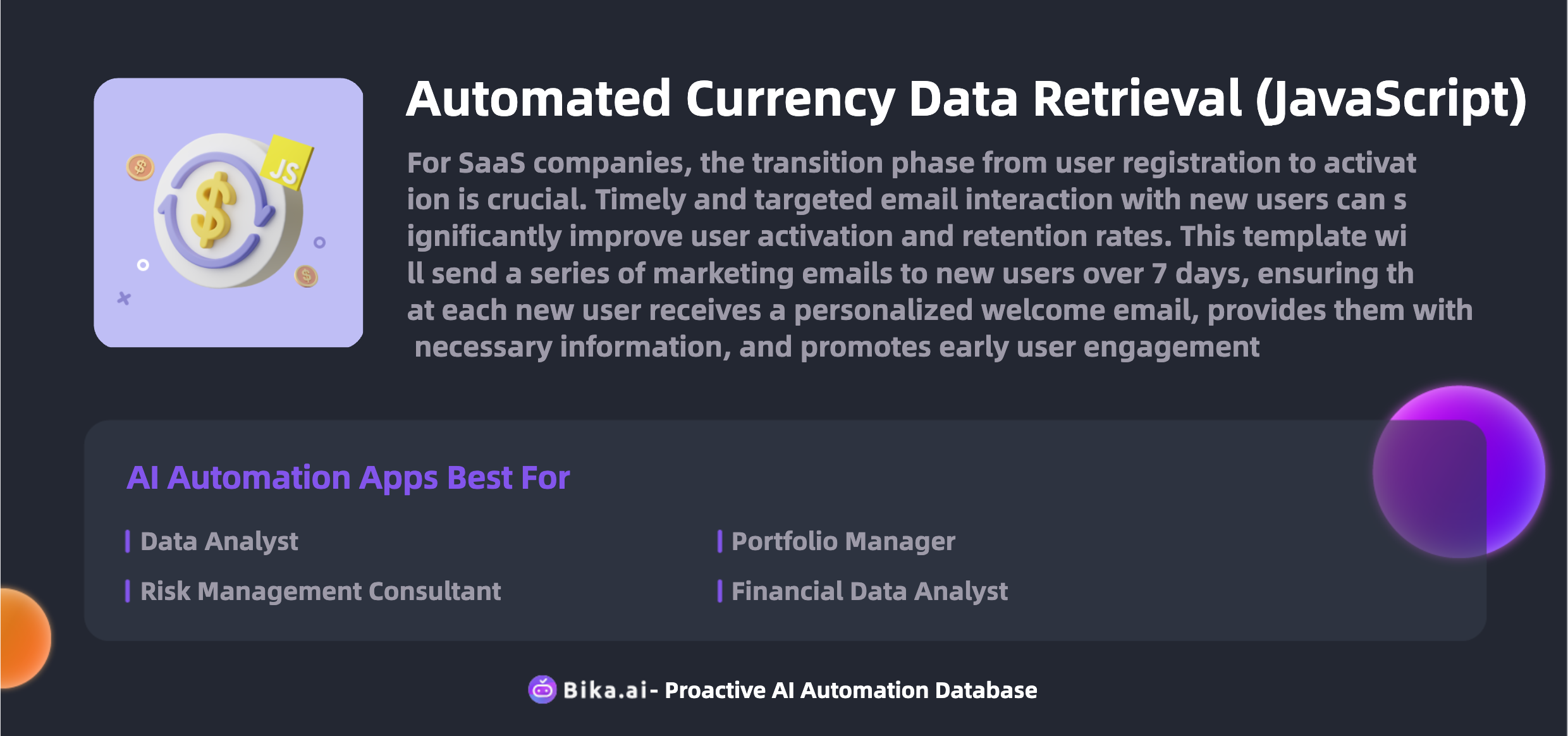

## Introduction to Bika.ai and the Automated Currency Data Retrieval (JavaScript) Template

Bika.ai is at the forefront of AI-powered data automation, providing innovative solutions that address the complex challenges of modern businesses. Their platform is designed to simplify and streamline data processes, making it easier for organizations to manage and analyze data.

The Automated Currency Data Retrieval (JavaScript) template is a prime example of Bika.ai's commitment to excellence. This intelligent and customizable tool is specifically tailored to handle the unique demands of risk assessment. With its AI precision and adaptability, it can handle large volumes of data and complex tasks with ease.

## Key Benefits of Bika.ai's Automated Currency Data Retrieval (JavaScript) Template for AI Data Automation

The advantages of using the Automated Currency Data Retrieval (JavaScript) template are numerous. Firstly, it significantly enhances efficiency by automating repetitive tasks, reducing the manual workload and allowing teams to focus on more strategic activities. Secondly, it improves data accuracy, minimizing the risk of errors that can occur with manual data entry.

In addition, the template is highly cost-effective, providing a valuable return on investment. It's specifically designed to address the nuanced needs of risk assessment, providing insights that are tailored to the unique requirements of this domain.

## Real-World Applications of the Automated Currency Data Retrieval (JavaScript) Template in AI Data Automation

Let's take a look at some practical use cases where the Automated Currency Data Retrieval (JavaScript) template has made a significant impact. In one instance, a financial institution was able to streamline its risk assessment process by using the template to retrieve and analyze currency data in real-time. This allowed them to make more informed investment decisions and manage risks more effectively.

Another example is a global manufacturing company that used the template to monitor exchange rate fluctuations and adjust their supply chain strategies accordingly, optimizing costs and minimizing risks.

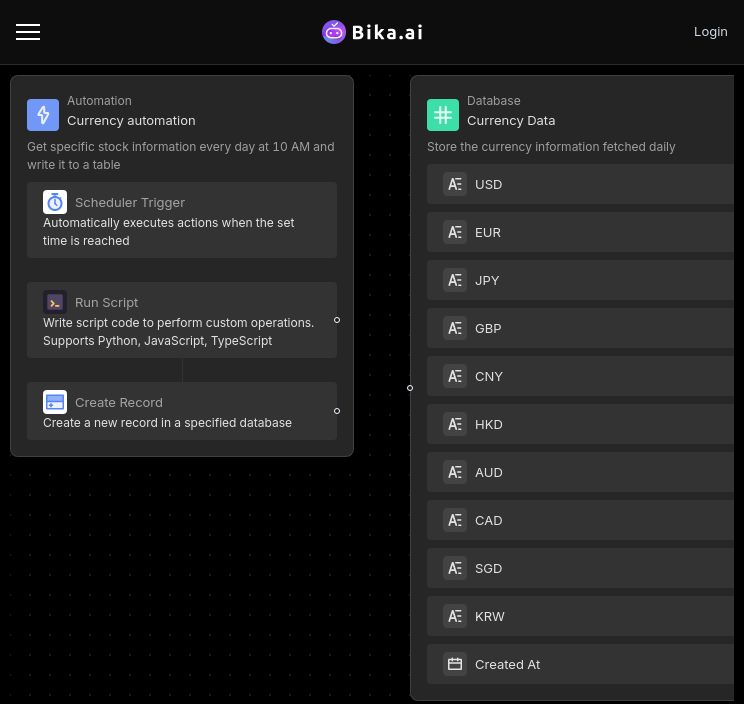

## Getting Started with the Automated Currency Data Retrieval (JavaScript) Template

Getting started with the Automated Currency Data Retrieval (JavaScript) template is straightforward. First, users need to install the template on the Bika.ai platform. Then, they can configure the automation task by modifying the trigger conditions and execution actions based on their specific needs.

It's important to test the automation task to ensure it's working as expected. Once everything is set up correctly, users can start reaping the benefits of real-time and accurate currency data retrieval.

## Conclusion: Unlocking the Potential of AI Data Automation with the Automated Currency Data Retrieval (JavaScript) Template

The transformative power of AI data automation in risk assessment scenarios cannot be overstated. Bika.ai's Automated Currency Data Retrieval (JavaScript) template offers an unparalleled solution that simplifies data processes, saves time, and enhances decision-making. It's time to embrace this technology and unlock the full potential of your risk assessment workflows. So, why not give it a try and experience the benefits for yourself?

Recommend Reading

- AI Data Automation with Bika.ai: Unlocking New Potential for Design project pipeline in Client progress update

- Airtable Pricing vs. Bika.ai Pricing: Which is More Advantageous for Foster audience engagement?

- Airtable Pricing vs. Bika.ai Pricing: Which is More Advantageous for Diversification strategies?

- Data Automation with Bika.ai: Unlocking New Potential for Portfolio Manager with Automated Currency Data Retrieval (JavaScript)

- The Secret Weapon for SaaS Success: Bika.ai's 7-Day Marketing Email Automation

Recommend AI Automation Templates